What is Airdrop Farming?

Airdrops have historically been one of the best ways to profit in crypto with little upfront capital required. When crypto projects want to decentralise ownership and reward early users, they commonly airdrop a portion of their tokens to users who meet certain criteria. Common criteria includes bridging to the protocol’s chain, performing transitions on-chain and minting NFTs. From small investments of gas and transaction fees, individuals have received $1,000s in return.

Knowing that new protocols are likely to reward early users upon launching their token, astute investors strategically farm new protocols in order to receive the largest airdrop possible. Their strategy often includes using a protocol across several wallets.

Why You Should Create a New Wallet For Airdrop Farming

Using multiple wallets instead of 1 can result in a larger overall airdrop. With multiple wallets it’s easier to meet the minimum criteria across several wallets than higher airdrop criteria in one wallet. This is because to receive the maximum airdrop amount on one wallet, a user needs to process high volume, requiring a lot of capital. Comparatively, a user with only a small amount of capital can meet the minimum criteria which usually only involves bridging some funds, interacting with a few contracts and processing some transactions. By repeating their airdrop strategy over several wallets, an individuals can be eligible for the same airdrop several times over.

Why You Shouldn’t Create a New Wallet From A Centralised Exchange

Protocols have realised users farm their airdrops across multiple wallets. This isn’t something protocols want, as it results in more tokens ending up in the hands of fewer users, leading to less decentralisation of the token.

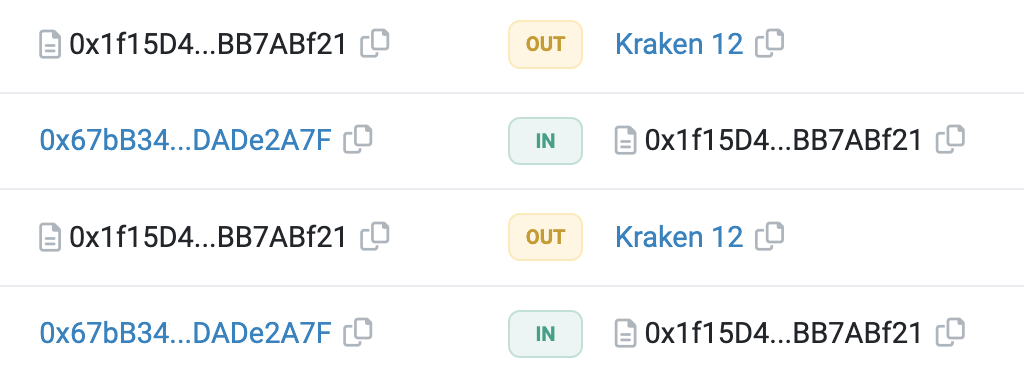

Through on-chain analysis, protocols can identify wallets they suspect are owned by one single person. When a user completes transactions on one wallet, then sends funds to another wallet to complete transactions on as well it is picked up by the protocol as being owned by one owner. This is not an effective strategy to keep your new wallet address private.

In order to obscure their transfer to a new wallet, users have tried to sending crypto to their centralised exchange account, then withdrawing to a new wallet address. Unfortunately for users, protocols now enlist the help of centralised exchanges to identify users who are doing this to farm their airdrop. They can also look at on-chain data to identify exchange wallets and transfers in and out and exclude them from the airdrop.

That’s why it’s best for airdrop farmers to set up a fresh wallet that is unconnected through any transactions to their other wallets.

How To Set Up and Fund a New Wallet With OpenPeer

- Create a new wallet in Metamask by selecting Add Account from the dropdown options at the top of the window. Follow the steps to generate a new wallet

- Go to https://app.openpeer.xyz/ and connect the new wallet

- Select the appropriate chain, token and fiat currency you wish to trade

- Find an Ad and complete the trade

Then you’re ready to airdrop farm from a fresh wallet!

Speculated Airdrops You Can Use This Strategy For

In past bull markets users made many thousands of dollars using protocols normally. Common signs a protocol will launch a good airdrop are that they raised VC money and do not yet have a token. The most anticipated current airdrops on chains OpenPeer supports are LayerZero, Orbiter, DELV, Airswap, Thetanuts Finance, Ondo, MetaStreet, Vertex, Metamask, Rift Finance, SynFutures, Set Protocol, Perennial, Cega, Portal, Astria and many more. You can also onramp directly onto Polygon with no gas fees, then bridge cheaply onto chains with expected airdrops such as ZKSync, Zora, Starknet & Scroll.

Disclaimer: This is not financial advice. All advice in this blog is general in nature and does not take into account your individual situation. You should consult with a professional or do your own research before investing in cryptocurrency.